Call Now, Agents Standing By: 888-507-6962

- Solutions

Industry

Retail

Revolutionize retail transactions with our cutting-edge solutions, ensuring seamless and secure payments.

High-Risk

Customized Approaches to Safely Handle High-Risk Transactions

Automotive

Customized Approaches to Safely Handle High-Risk Transactions

Professional Services

Redefine professional services through our secure and streamlined payment processes.

E-Commerce

Empower your eCommerce ventures with 247Payments, ensuring a superior online transaction experience.

Healthcare

Empower your eCommerce ventures with 247Payments, ensuring a superior online transaction experience.

FEATURES

Point of Sale

Effortless in-person transactions with our efficient Point-of-Sale systems.

Virtual Terminal

Secure Virtual Terminals for keyed transactions, providing peace of mind for online payments.

Invoice Solutions

Seamless eCommerce with our white-label checkout features, ensuring a smooth experience.

Buy Now, Pay Later

Transforming Purchases into Possibilities – Explore Our Buy Now, Pay Later Offerings

Surcharge / Dual Pricing

Simplify invoicing and enhance your business cash flow with our advanced invoicing solutions.

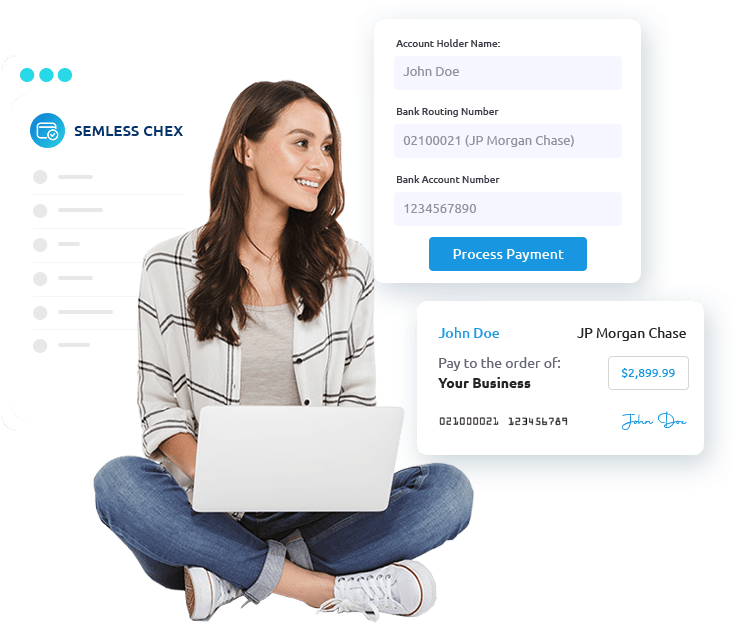

ACH / eCheck

Facilitate ACH/eCheck transactions with ease, offering flexibility and security.

Mobile Payments

Convenient mobile payments on the go, making transactions easier for your customers.

- Equipment

Equipment

Restaurant

Optimized equipment designed for the unique needs of restaurant transactions.

Retail

Cutting-edge solutions for retail businesses, ensuring efficient and secure transactions.

Register

Efficient register systems for businesses of all sizes, streamlining the payment process.

Terminal

Versatile terminals catering to diverse business needs, providing flexibility and reliability.

Mobile POS

Mobile POS and Pay options for businesses on the move, ensuring convenience and adaptability.

Mobile Pay

Perspiciatis unde omnis elit natus error do tempor

- Pricing

Transparent and Competitive Rates for Your Business

Our Rates

Explore our competitive rate plans tailored to meet the specific needs of your business.

Interchange+

Maximize savings with our Interchange+ pricing model, providing cost-effective solutions.

Zero Cost Processing

Experience the benefits of zero-cost processing, optimizing your financial transactions.

Merchant Statement Analysis

Unlock insights with our merchant statement analysis, ensuring transparency and understanding.

- Company

Get to know Us

About Us

Discover the 247Payments story, built on a foundation of trust, innovation, and excellence.

Leadership

Meet the visionary leaders behind our success, driving the future of payment technology.

Careers

Join us in shaping the future of payments, where collaboration and innovation thrive.

- Resources

24/7 PAYMENT CENTER

Help & Support

Access 24/7 help and support, ensuring peace of mind for all your payment-related queries.

FAQ

Find answers in our frequently asked questions, providing quick solutions to common inquiries.

Blog

Stay informed with our insightful blog, offering valuable industry updates and expert insights.

- Contact

888-507-6962

- Solutions

Industry

Retail

Revolutionize retail transactions with our cutting-edge solutions, ensuring seamless and secure payments.

High-Risk

Customized Approaches to Safely Handle High-Risk Transactions

Automotive

Customized Approaches to Safely Handle High-Risk Transactions

Professional Services

Redefine professional services through our secure and streamlined payment processes.

E-Commerce

Empower your eCommerce ventures with 247Payments, ensuring a superior online transaction experience.

Healthcare

Empower your eCommerce ventures with 247Payments, ensuring a superior online transaction experience.

FEATURES

Point of Sale

Effortless in-person transactions with our efficient Point-of-Sale systems.

Virtual Terminal

Secure Virtual Terminals for keyed transactions, providing peace of mind for online payments.

Invoice Solutions

Seamless eCommerce with our white-label checkout features, ensuring a smooth experience.

Buy Now, Pay Later

Transforming Purchases into Possibilities – Explore Our Buy Now, Pay Later Offerings

Surcharge / Dual Pricing

Simplify invoicing and enhance your business cash flow with our advanced invoicing solutions.

ACH / eCheck

Facilitate ACH/eCheck transactions with ease, offering flexibility and security.

Mobile Payments

Convenient mobile payments on the go, making transactions easier for your customers.

- Equipment

Equipment

Restaurant

Optimized equipment designed for the unique needs of restaurant transactions.

Retail

Cutting-edge solutions for retail businesses, ensuring efficient and secure transactions.

Register

Efficient register systems for businesses of all sizes, streamlining the payment process.

Terminal

Versatile terminals catering to diverse business needs, providing flexibility and reliability.

Mobile POS

Mobile POS and Pay options for businesses on the move, ensuring convenience and adaptability.

Mobile Pay

Perspiciatis unde omnis elit natus error do tempor

- Pricing

Transparent and Competitive Rates for Your Business

Our Rates

Explore our competitive rate plans tailored to meet the specific needs of your business.

Interchange+

Maximize savings with our Interchange+ pricing model, providing cost-effective solutions.

Zero Cost Processing

Experience the benefits of zero-cost processing, optimizing your financial transactions.

Merchant Statement Analysis

Unlock insights with our merchant statement analysis, ensuring transparency and understanding.

- Company

Get to know Us

About Us

Discover the 247Payments story, built on a foundation of trust, innovation, and excellence.

Leadership

Meet the visionary leaders behind our success, driving the future of payment technology.

Careers

Join us in shaping the future of payments, where collaboration and innovation thrive.

- Resources

24/7 PAYMENT CENTER

Help & Support

Access 24/7 help and support, ensuring peace of mind for all your payment-related queries.

FAQ

Find answers in our frequently asked questions, providing quick solutions to common inquiries.

Blog

Stay informed with our insightful blog, offering valuable industry updates and expert insights.

- Contact